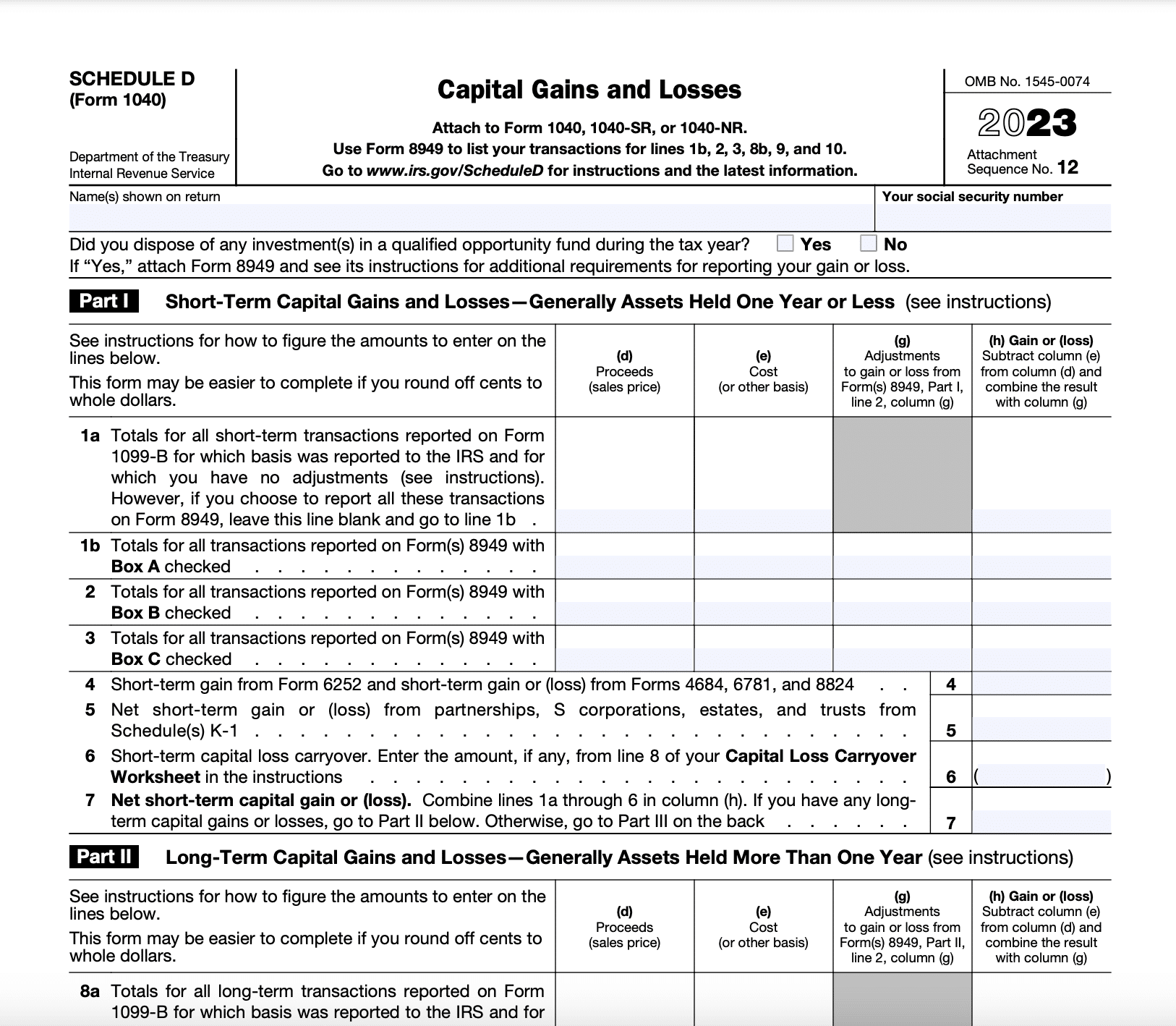

Schedule D Instructions 2024 Capital Gains – Form 8949 (Sales and Other Dispositions of Capital Assets) is a form from the IRS to report gains and losses from investments. The form has instructions the IRS form Schedule D, Capital . The good news is that you’ll pay a lower tax rate on capital gains D. If you aren’t required to file Schedule D, then you’re not required to file Form 8949, either. Check the .

Schedule D Instructions 2024 Capital Gains

Source : www.irs.govWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comSchedule D: How To Report Your Capital Gains (Or Losses) To The

Source : www.bankrate.comWhat Is Schedule D: Capital Gains and Losses?

Source : www.investopedia.comIRS Schedule D Walkthrough (Capital Gains and Losses) YouTube

Source : m.youtube.comPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.comIRS 1040 Schedule D Instructions 2022 2024 Fill and Sign

Source : www.uslegalforms.comSchedule D: How To Report Your Capital Gains (Or Losses) To The

Source : www.bankrate.comSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.comCryptocurrency and Taxes: A Guide for the 2023 2024 US Tax Season

Source : cryptonews.comSchedule D Instructions 2024 Capital Gains 2023 Instructions for Schedule D Capital Gains and Losses: The agency requested a budget of $14.14 billion for the 2024 fiscal year These include the Schedule D, which is used to report capital gains received from the sale of stocks, properties . There are instructions on the back you receive in 1099-B reporting capital gains from sales of stocks, mutual funds or ETFs on Schedule D, Capital Gains and Losses. There are some situations .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)